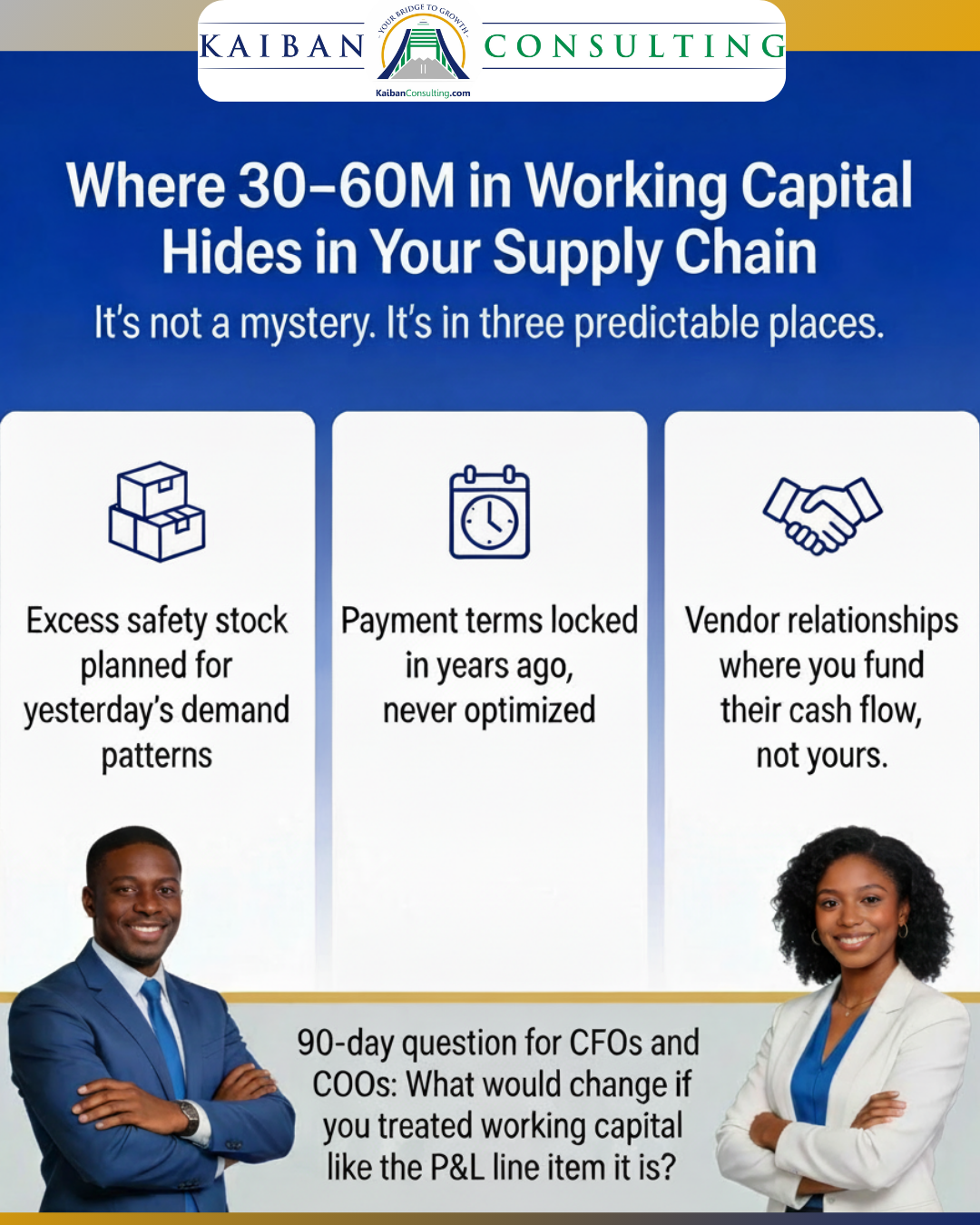

Many mid-market CFOs have 30–60M in working capital sitting trapped in their supply chain—and they don't even know it's there.

It's not hidden in some exotic financial instrument. It's in inventory you're holding because demand planning is stuck on quarterly cycles. It's in payment terms you negotiated five years ago and never revisited. It's in vendor relationships where you're funding their working capital instead of optimizing your own.

The companies that free this capital in 90 days aren't doing anything magical. They're asking three questions most finance teams skip:

Where is cash conversion cycle actually breaking down?

Which vendors would trade better service for faster payment?

What's the real cost of holding safety stock we planned for a different business model?

Fortune 500 teams ask these questions every quarter. Mid-market leaders should too.